What makes real estate great? When investing in a home, whether it's your first or a subsequent investment property, one of your primary considerations should be its money-making potential. As you may know, the type of home you buy will have a large affect on its potential to turn profit.

So is a detached home or an apartment better in that sense? Let's have a closer look at detached homes, to help make this decision just a little easier for you.

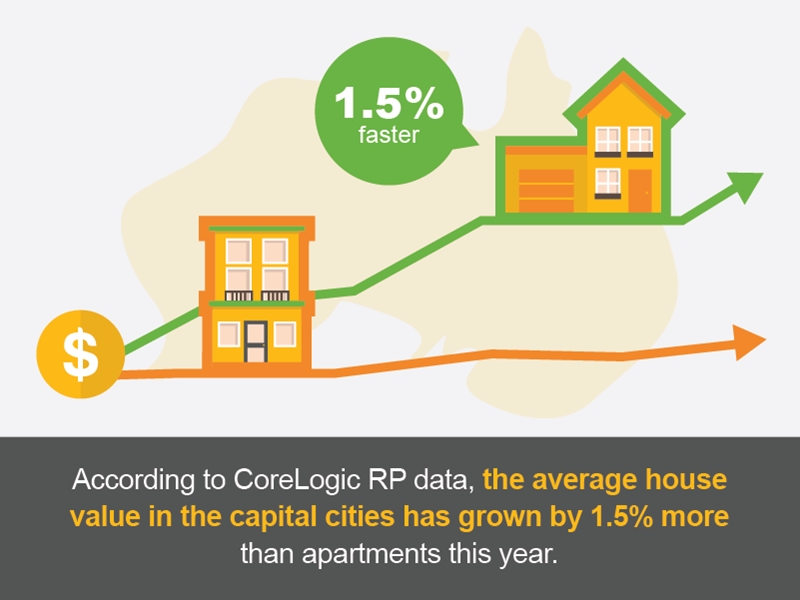

Higher capital gains

Historically houses have always shown higher capital gains than apartments or units. This may be due to the fact that when you purchase a detached house, you also receive the land underneath it – which is increasingly scarce and worth more than the structure itself in most areas.

Evidence of this can be see in CoreLogic RP Data's monthly indices, which show house prices have been growing faster than that of units for the past year in most areas of the country. In fact, the capital city average shows that the average house value has grown by 1.5 per cent more than apartments and units this year.

In Melbourne, Brisbane and Canberra the average value for detached houses has grown at least 4.5 per cent faster than that of units. This shows that if you can afford it spending your investment home loan on a detached house may be the smarter option.

More extra (and up front) costs

During the summer of 2015 Australia experienced its biggest apartment boom ever.

Unfortunately more capital gains comes with more costs for those yet to buy, including a higher purchase price. CoreLogic data shows that in Sydney the average price for a home is almost $400,000 more than that of units. Averaged cross the five biggest capital cities this difference is slightly less, sitting at about $200,000.

You may also find that detached homes have more extra costs associated such as maintenance or land tax.

Apartments may drop in price

It may be worth purchasing a detached home if you're aiming to maximise capital gains from your investment, as apartments prices may drop in future. This may be in part thanks to to the fact that during the summer of 2015 Australia experienced its biggest apartment boom ever with over 80,000 in construction.

Almost 200,000 were also in the planning or marketing phases, which explains why a QBE report has forecasted drops in apartment prices in all cities but Brisbane and Adelaide by 2017.